This Content Is Only For Paid Member

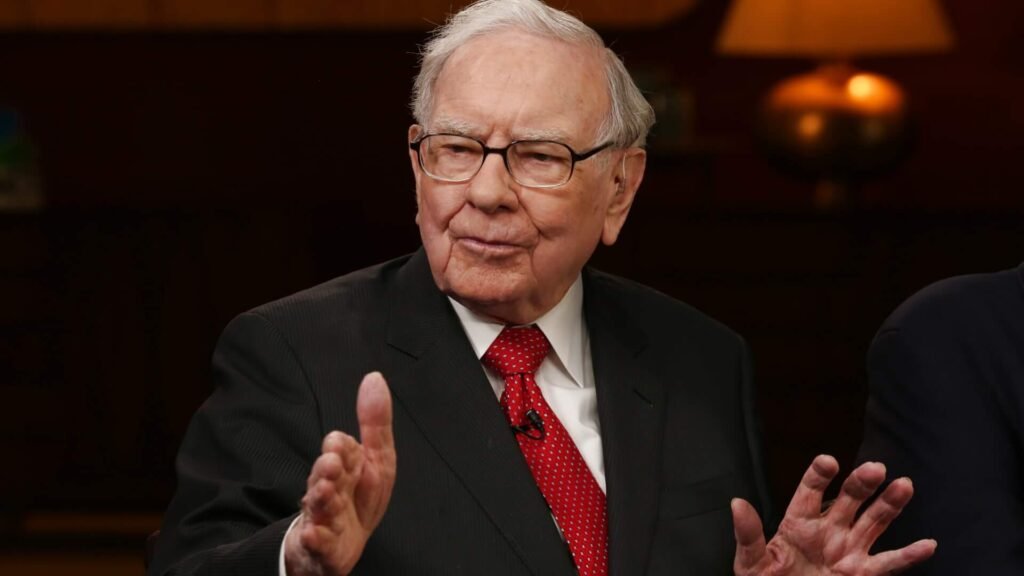

Warren Buffett’s Berkshire Hathaway is on the verge of demonstrating that persistently high interest rates have, paradoxically, worked in its favor. The Omaha, Nebraska-based conglomerate operates across a wide spectrum of industries, from railroads and energy to candy and insurance, making it susceptible to higher interest rates, which can potentially dampen demand. However, Berkshire also maintains a substantial cash reserve primarily invested in short-term Treasury bills. This cash pile is now experiencing a boost from elevated interest rates, thanks to the Federal Reserve’s efforts to control inflation.

According to Jim Shanahan, an analyst with Edward Jones, Berkshire is “clearly benefiting from higher short-term interest rates.” While some businesses face challenges as interest rates rise, such as those involved in home and car sales, Berkshire’s gains outweigh the negative impacts.

For the full year, Berkshire is anticipated to generate interest and other investment income of $5.5 billion, a significant increase from the $1.7 billion recorded in 2022, as predicted by Shanahan. This surge in income may push Berkshire’s cash reserve to a new high, potentially surpassing the previous record of $149.2 billion established in the third quarter of 2021. Furthermore, analysts are forecasting a more than 30% rise in operating earnings to $9 billion.

Berkshire Hathaway’s financial performance is closely monitored as a barometer of the broader US economy’s health due to the conglomerate’s extensive range of businesses, which includes prominent names like BNSF, Geico, and Dairy Queen. While the company’s results are expected to be strong, analysts like Meyer Shields from KBW acknowledge that there are some headwinds to contend with.

One such headwind pertains to Berkshire’s equity portfolio, valued at $350 billion and dominated by holdings in Apple Inc. During the third quarter, Apple’s shares experienced a 12% drop, potentially resulting in an 8% loss for the portfolio during the same period, according to Bloomberg Intelligence analysts. Overall, the portfolio may incur approximately $27 billion in pretax unrealized investment losses for the quarter, based on these estimates.

However, Berkshire has consistently advised investors to look beyond investment gains or losses, emphasizing that these figures can be misleading due to accounting rules. Ultimately, Berkshire Hathaway’s performance reflects the intricate interplay of investments, interest rates, and its extensive portfolio of businesses.