This Content Is Only For Paid Member

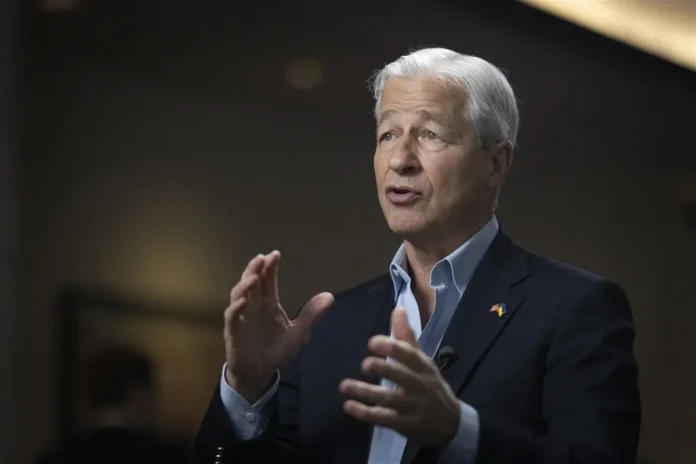

Earlier this week, Jamie Dimon captured the world’s attention by characterizing the current global landscape as “perhaps the most dangerous time the world has seen in decades.” His words certainly carry weight, particularly when viewed through a geopolitical lens. Ongoing conflicts in Ukraine and Israel have far-reaching implications. Dimon also drew attention to the Federal Reserve’s quantitative tightening program, which is taking place amid persistent inflation.

When a figure as influential as Jamie Dimon, one of the most powerful CEOs globally, makes such a dramatic statement, it’s prudent to take heed, as my colleague Brian Sozzi pointed out.

However, in the realm of financial markets, it is essential to consider whether there might be ulterior motives behind such statements. “For Jamie Dimon, a bank that consistently outperforms its peers, his mission is to manage expectations. Each quarter, he strives to lower the bar because JPMorgan Chase consistently outperforms and excels across all business lines,” remarked Ken Leon, an experienced bank analyst at CFRA, during a conversation with Yahoo Finance Live. (Incidentally, JPMorgan Chase is one of Leon’s top recommendations).

Nevertheless, if one chooses to disregard Dimon’s warnings, there are several reassuring indicators to consider.

For instance, the retail sales report released on Tuesday surpassed economists’ expectations. While this may intensify the pressure on the Federal Reserve to once again raise interest rates, central bank officials have consistently conveyed a message of patience over the past few weeks. The uptick in Treasury yields is helping to tighten financial conditions without necessitating further interest rate hikes at this time.

Bolstered by robust retail sales data, the Atlanta Federal Reserve’s GDPNow forecast now stands at an annualized growth rate of 5.4% for the third quarter. The S&P 500 has rebounded by more than 3% since early October, and early earnings reports from major banks and companies like Johnson & Johnson have exceeded expectations.

Furthermore, Bank of America’s weekly fund flows data revealed the eleventh consecutive week of inflows into equities. Investors are showing a preference for cyclical assets over defensive ones, signaling optimism about economic growth.

Perhaps investors should heed Dimon’s subsequent words: “While we hope for the best, we prepare the Firm for a broad range of outcomes so we can consistently deliver for clients no matter the environment.”

In other words, despite the positive economic and market signals, it’s always wise to be prepared for any eventuality.