Semiconductor stocks have been thriving in the market, evidenced by the remarkable 56% gains in the PHLX Semiconductor Sector index over the past year. Notably, graphics specialist Nvidia (NASDAQ: NVDA) has played a leading role in this surge, with its shares soaring by a staggering 233%, fueled by its dominant position in the market for artificial intelligence (AI) chips.

Nvidia’s GPUs have experienced robust demand, particularly for training large language models (LLMs) essential for applications like ChatGPT, with each AI-focused GPU reportedly commanding prices ranging from $10,000 to $30,000. However, amidst the company’s impressive performance, Citi analyst Atif Malik believes that Marvell Technology (NASDAQ: MRVL) could offer a more compelling investment opportunity than Nvidia. Let’s delve into the reasons behind this assertion.

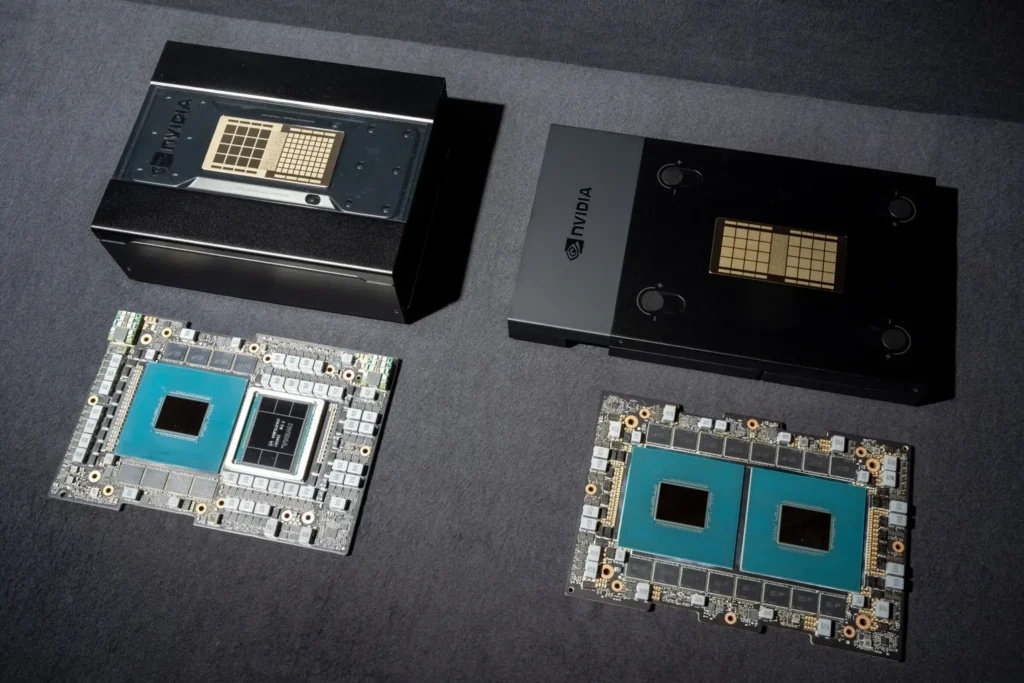

Marvell Technology is emerging as a formidable player in the AI semiconductor space, supported by its offerings of custom AI chips and optical modules facilitating high-speed communication between data centers. Malik maintains his buy rating on Marvell stock, citing the company’s favorable positioning to capitalize on the increasing demand for custom AI chips. Rick Schafer of Oppenheimer echoes this sentiment, anticipating a surge in Marvell’s sales driven by its AI exposure and strong demand for data center storage and switching solutions.

A closer examination of Marvell’s semiconductor solutions reveals its specialization in custom application-specific integrated circuits (ASICs), tailored to meet the unique requirements of AI, cloud data centers, and original equipment manufacturer (OEM) customers. Major cloud service providers like Microsoft, Alphabet, and Meta Platforms are investing in custom ASICs to enhance performance and power efficiency, recognizing their ability to accelerate AI training and inference models.

Morgan Stanley forecasts that ASICs could capture 30% of the AI chip market by 2027, potentially reaching a market value of $182 billion. This projection suggests significant growth opportunities for Marvell, which reportedly holds a 12% share of the ASIC market, according to JPMorgan.

Analysts anticipate accelerated revenue growth for Marvell, fueled by its AI-related offerings, with revenue estimates reaching $7.3 billion by 2026. Considering the potential incremental revenue of $6.6 billion from AI-focused ASICs by 2027, Marvell’s market capitalization could surge by 71% from current levels, based on historical price-to-sales ratios.

With Marvell trading at a relatively modest valuation compared to Nvidia, investors seeking exposure to the burgeoning AI market may find Marvell Technology an attractive alternative. While Nvidia trades at 33 times sales, Marvell’s valuation at 11 times sales appears more favorable, suggesting promising prospects for long-term growth.

In conclusion, Marvell Technology emerges as a compelling investment opportunity poised to benefit from the expanding demand for custom AI chips, presenting investors with the potential for significant upside in the semiconductor space.