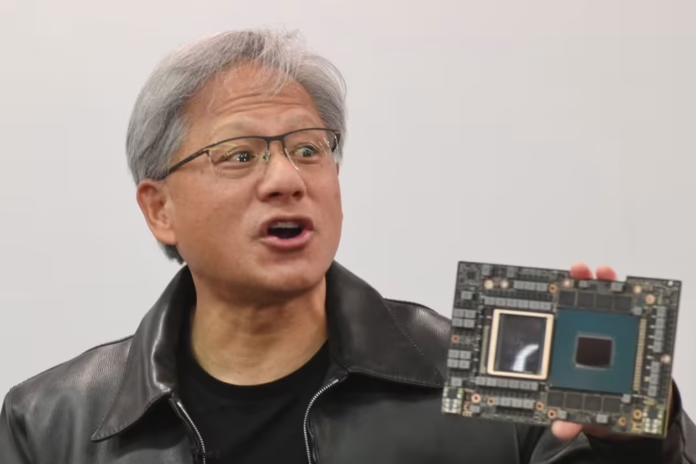

While U.S. futures and oil prices also somewhat fell, Asian markets largely fell on Wednesday following a quiet Wall Street session. The largest jolt came from Nvidia, whose shares fell 6.3% in after-hours trade on the company’s announcement of stricter U.S. export controls on its AI-focused chips.

Despite GDP statistics indicating the world’s second-largest economy expanded at a robust 5.4% annual rate last quarter, markets led regional losses in China. Growth, however, fell quarterly from 1.6% in Q4 2024 to 1.2% in Q1 2025, which worried investors.

Especially after US President Donald Trump reinstated severe tariffs, boosting taxes on most Chinese imports to 145%, private economists are becoming wary. China increased taxes on American products to 125% in reaction. ANZ Research analysts said Trump’s erratic trade strategy, not the tariffs themselves, was to blame for the economic ambiguity. Raymond Yeung and his ANZ colleagues observed, “Business sentiment is suffering.”

Asian Markets Overview:

Nikkei 225 (Japan): 22,948.18, -0.9%

Kospi (South Korea): 2,461.45, down 0.7%

S&P/ASX 200 (Australia): 7,781.10 +0.3%

Sensex (India): EvenWhile U.S. futures and oil prices also somewhat fell, Asian markets largely fell on Wednesday following a quiet Wall Street session. The largest jolt came from Nvidia, whose shares fell 6.3% in after-hours trade on the company’s announcement of stricter U.S. export controls on its AI-focused chips.

Despite GDP statistics indicating the world’s second-largest economy expanded at a robust 5.4% annual rate last quarter, markets led regional losses in China. Growth, however, fell quarterly from 1.6% in Q4 2024 to 1.2% in Q1 2025, which worried investors.

Especially after US President Donald Trump reinstated severe tariffs, boosting taxes on most Chinese imports to 145%, private economists are becoming wary. China increased taxes on American products to 125% in reaction. ANZ Research analysts said Trump’s erratic trade strategy, not the tariffs themselves, was to blame for the economic ambiguity. Raymond Yeung and his ANZ colleagues observed, “Business sentiment is suffering.”

SET (Thailand): up 0.2%Tuesday saw U.S. stocks move closely. The S&P 500 fell 0.2% to 5,396.63, the Dow Jones 0.4% to 40,368.96, and the Nasdaq marginally to 16,823.17. Investor focus stays glued on the changing trade strategy under Trump.

After last week’s turbulence, the U.S. bond market settled. Down from a recent high of 4.48%, the 10-year Treasury yield remained constant at 4.33%. The U.S. dollar, meanwhile, indicated some stabilisation after a quick drop, which calmed concerns the continuing trade spat may compromise its standing as a worldwide safe haven.

Significant Movers:

After revealing a ransomware assault impacting certain operations, DaVita dropped 3% for a second straight session.

Bank of America: Increased 3.6% on better-than-expected quarterly profits.

Gained 1.8%, thereby above analyst estimates, Citigroup.

Palantir Technologies: Rose 6.2% on word NATO would use its artificial intelligence technology for allied operations.Markets for Oil & Currency

Down 19 cents to $61.14/barrel, U.S. Crude

Brent Crude: Down 18 cents to $64.49 per barrel

Fell to 142.61 from 143.24 in USD/JPY

EUR/USD: From $1.1283, it increased to $1.1336Analysts warn that especially for energy and raw materials, the fresh wave of tariffs would dampen worldwide demand.