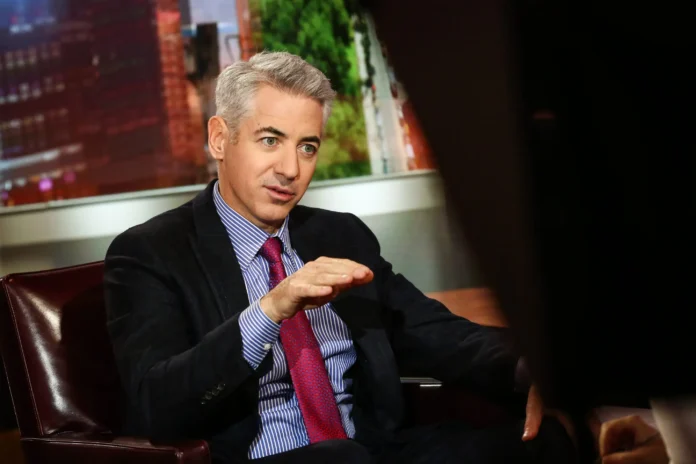

Renowned billionaire hedge fund manager Bill Ackman has made a notable change in his investment strategy, shifting his focus from concerns about inflation to worries about a slowing economy. In early August, Ackman made headlines by revealing his short position on 30-year Treasury bonds using options, anticipating a scenario of persistently higher inflation and, subsequently, rising 30-year Treasury yields. However, his recent actions suggest a shift in his perspective.

Ackman has decided to close his bet against 30-year Treasury bonds, citing his belief that the global economy is slowing down more rapidly than recent data indicates. He voiced concerns about the significant risk in the world’s current state, leading to his change of position.

A combination of a less robust U.S. economy and elevated geopolitical tensions has diminished the likelihood of prolonged inflation and higher long-term Treasury yields. To sustain high long-term yields, the Federal Reserve would need to maintain elevated interest rates for an extended period. This becomes unlikely if the economy is indeed experiencing a slowdown, as Ackman suggests, or if international conflicts escalate.

Ackman’s move to exit his short position on the 30-year Treasury could be indicative of a shift in his primary concern, moving from an overheated economy with higher interest rates and inflation to a slowing economy at risk of recession due to geopolitical uncertainties.

Although Ackman’s short position on bonds was brief, it proved profitable. However, the exact amount of his gains remains undisclosed. Over the same period, year-over-year inflation increased from 3% in June to 3.7% last month, and the 30-year Treasury yield surged from 4.16% on August 2 to just over 5% when Ackman closed his position.

His timing appears to have been apt, with the 30-year Treasury yield reaching as high as 5.17% on the same day he exited his short position. News of the rising death toll in the Israel-Hamas conflict contributed to investor unease, subsequently pushing the yield back below 5%.

As is typical in financial markets, not everyone shares Ackman’s views on the future of inflation, interest rates, and Treasury yields. Brent Schutte, Chief Investment Officer at Northwestern Mutual Wealth Management Co., pointed out that wage growth remains high and could be incongruent with the goal of lowering inflation to 2%. He also highlighted robust consumer spending, supported by recent retail sales reports, which might necessitate the Federal Reserve to maintain higher interest rates to ensure price stability.

Lisa Shalett, Chief Investment Officer at Morgan Stanley Wealth Management, emphasized that investors remain concerned about fiscal instability amid political gridlock in Washington and record federal deficits. These concerns may lead investors to demand higher yields for holding Treasuries.

She added, “The growing rout in Treasuries reflects bond investors’ desire to be compensated for an expanding list of risks, which now increasingly include geopolitical instability and demands on fiscal spending, as the country already struggles to finance its deficit.” Developments in Washington, Fed policy, and the role of the U.S. dollar as a reserve currency are significant factors in this context.