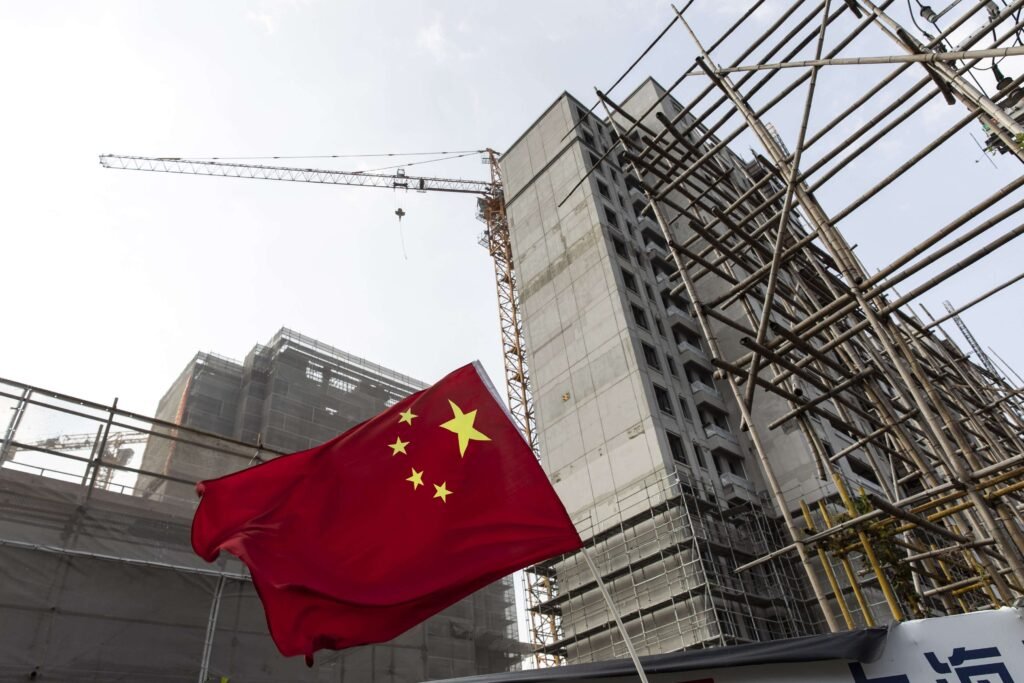

Chinese stocks experienced a decline, pulling down Asian equities, in response to disappointing inflation data over the weekend and some dissatisfaction with a Politburo meeting. Mainland China stocks dropped nearly 1%, causing a regional gauge to slide for a second session, after data revealed a steeper-than-expected fall in consumer prices, the sharpest in three years. Some market participants expressed disappointment as China’s regulators omitted “forceful” language when outlining monetary policy for 2024, as reported by Bloomberg Intelligence. Concurrently, the dollar strengthened against most major peers.

The rest of the region witnessed mixed market movements as traders anticipated a week filled with significant events, including U.S. inflation data on Tuesday, a Federal Reserve policy decision on Wednesday, and retail sales numbers on Thursday.

Citigroup economists, led by Xinyu Ji, highlighted that China’s deflation situation is intensifying due to factors such as domestic food price declines, corrections in international oil prices, and weak domestic demand. They emphasized the urgency for policy action to prevent a detrimental loop between deflation, confidence, and economic activities, suggesting a rising risk of reserve-requirement ratio and/or rate cuts.

In a meeting on Friday, China’s top leaders pledged to strengthen fiscal support and underscored the importance of economic progress. The Politburo indicated that monetary policy should be flexible, appropriate, targeted, and effective, with the omission of the previous “forceful” terminology.

Willer Chen, senior analyst at Forsyth Barr Asia Ltd., noted a more conservative tone in monetary and fiscal policy, suggesting a potentially smaller level of loosening in 2024 compared to 2023.

Elsewhere, Japan’s benchmark stock indexes surged by at least 1%, mirroring gains in Australian shares following a rally in U.S. equities on Friday. In contrast, Hong Kong’s indexes slid over 2%, while U.S. futures contracts showed minimal changes in Asia. Treasury 10-year yields maintained at 4.24%.

Looking ahead, traders will closely monitor policy decisions at the European Central Bank and Bank of England, along with economic data in Australia, jobs data in Europe, and U.S. inflation figures.

The week will also feature key events globally, including rate decisions in Argentina, the UK’s economic forecast publication, RBA Governor Michele Bullock’s speech, Japan’s producer prices, and more.

In cryptocurrency markets, Bitcoin and Ether saw declines, while oil prices remained volatile amid signs of supply outpacing demand.