This Content Is Only For Paid Member

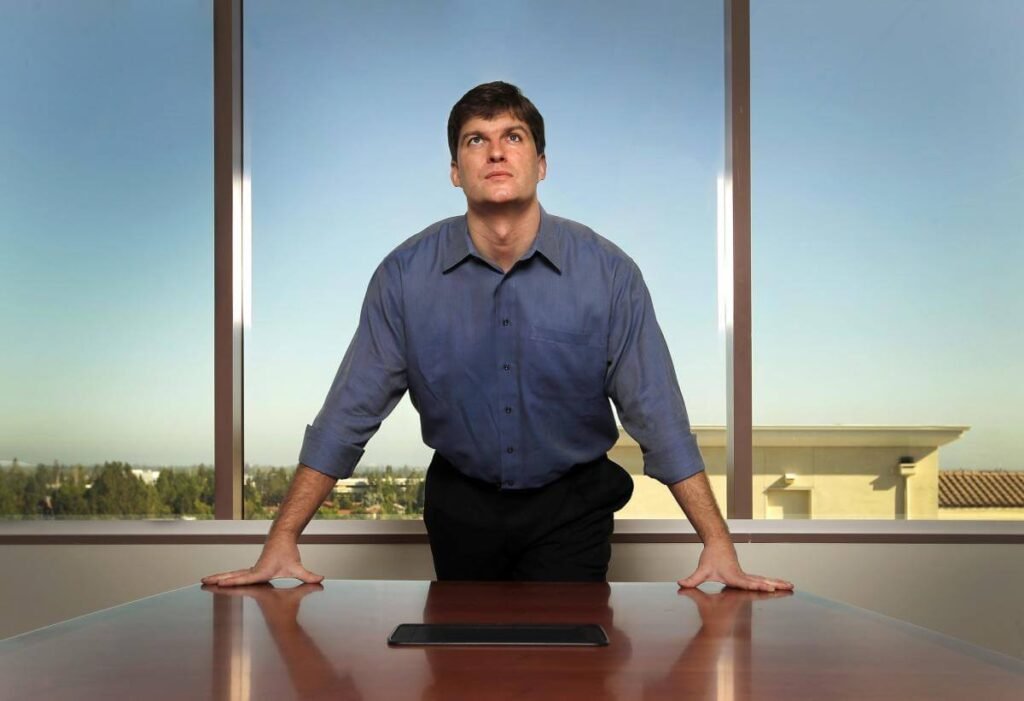

Renowned investor Michael Burry, famous for his role in “The Big Short,” has revealed significant changes in his investment strategy. While ending his bets against the S&P 500 and Nasdaq 100 in the last quarter, Burry’s latest portfolio update, filed with the Securities and Exchange Commission, discloses a new wager against semiconductor stocks.

Burry’s Scion Asset Management, which previously purchased bearish put options on the SPDR S&P 500 and Invesco QQQ, has notably shifted its focus. The latest filing shows the acquisition of puts on 100,000 shares of BlackRock’s iShares Semiconductor ETF, with a nominal value of $47 million. This ETF includes Nvidia, a graphics-chip specialist whose stock price has seen a significant surge this year due to growing excitement around artificial intelligence.

In a marked consolidation of his firm’s portfolio, Burry reduced the number of positions from 33 to 13, resulting in a total value (excluding options) dropping from $111 million to $44 million. This move is significant, considering Burry typically overhauls the majority of his portfolio every three months. Surprisingly, he increased his stakes in Euronav, Hudson Pacific Properties, Nexstar Media, Safe Bulkers, Star Bulk Carriers, and Stellantis during the last quarter. Additionally, he offloaded other positions and adjusted his bets on Crescent Energy and The Real Real. Notably, Burry purchased Alibaba shares and Booking.com shares and puts.

Michael Burry gained fame for his prescient bet against the mid-2000s housing bubble, as documented in “The Big Short.” He is also known for early investments in GameStop, predicting its rise before it became a meme stock in early 2021, and for making contrarian bets against Elon Musk’s Tesla and Cathie Wood’s Ark Innovation fund in recent years.

Renowned for his stark warnings, Burry has previously sounded alarms about what he deemed the “greatest speculative bubble of all time in all things” in the summer of 2021. He also cautioned buyers of meme stocks and cryptocurrencies, predicting they were signing up for the “mother of all crashes.”